Effective January 1, 2024, many corporations, limited liability company, limited partnerships and other types of legal entities are required by law to report certain information to the U.S. Department of Treasury’s Financial Crimes Enforcement Network (“FinCEN”). The Beneficial Ownership Information Reporting Rule (the “Reporting Rule”), adopted to implement the 2021 Corporate Transparency Act, is very broad in applicability and applies to many small businesses (including most single-member limited liability companies and holding companies). The Reporting Rule applies both to companies that were already in existence as of January 1, 2024, as well as companies formed on or after that date. A company that is subject to the Reporting Rule must report to FinCEN certain information about itself, its “beneficial owners” (i.e., the individuals who ultimately own or control the company), and, if the company was formed on or after January 1, 2024, its “company applicants.”

FinCEN has created a Frequently Asked Questions publication to help explain the Reporting Rule, as well as a Small Entity Compliance Guide. Here are some key excerpts from the FinCEN FAQ, as last updated on January 12, 2024:

Why do companies have to report beneficial ownership information to the U.S Department of the Treasury?

In 2021, Congress passed the Corporate Transparency Act on a bipartisan basis. This law creates a new beneficial ownership information reporting requirement as part of the U.S. government’s efforts to make it harder for bad actors to hide or benefit from their ill-gotten gains through shell companies or other opaque ownership structures.

What companies will be required to report beneficial ownership information to FinCEN?

Companies required to report are called reporting companies. There are two types of reporting companies:

- Domestic reporting companies are corporations, limited liability companies, and any other entities created by the filing of a document with a secretary of state or any similar office in the United States.

- Foreign reporting companies are entities (including corporations and limited liability companies) formed under the law of a foreign country that have registered to do business in the United States by the filing of a document with a secretary of state or any similar office.

Are some companies exempt from the reporting requirement?

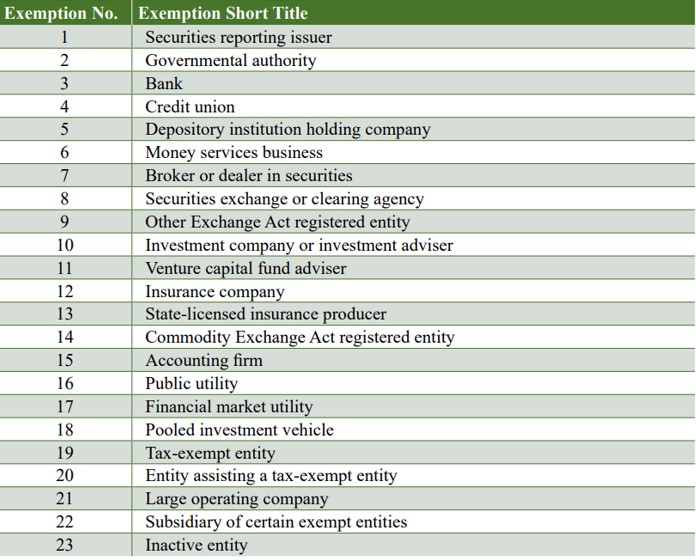

Yes, 23 types of entities are exempt from the beneficial ownership information reporting requirements. These entities include publicly traded companies meeting specified requirements, many nonprofits, and certain large operating companies.

The following table summarizes the 23 exemptions:

How does a company report to FinCEN that the company is exempt?

A company does not need to report to FinCEN that it is exempt from the beneficial ownership information reporting requirements if it has always been exempt.

If a company filed a beneficial ownership information report and later qualifies for an exemption, that company should file an updated beneficial ownership information report to indicate that it is newly exempt from the reporting requirements. Updated beneficial ownership information reports are filed electronically though the secure filing system. An updated beneficial ownership information report for a newly exempt entity will only require that the entity: (1) identify itself; and (2) check a box noting its newly exempt status.

When are the filings due?

- Any reporting company created or registered to do business before January 1, 2024 will have until January 1, 2025 to file its initial beneficial ownership information report.

- A reporting company created or registered in 2024 will have 90 calendar days to file after receiving actual or public notice that its creation or registration is effective.

- A recording company created or registered on or after January 1, 2025 will have 30 calendar days to file to file after receiving actual or public notice that its creation or registration is effective.

Will there be a fee for submitting a beneficial ownership information report to FinCEN?

No. There is no fee for submitting your beneficial ownership information report to FinCEN.

Is there a requirement to annually report beneficial ownership information?

No. There is no annual reporting requirement. Reporting companies must file an initial beneficial ownership information report and updated or corrected beneficial ownership information reports as needed.

Can a parent company file a single beneficial ownership information report on behalf of its group of companies?

No. Any company that meets the definition of a reporting company and is not exempt is required to file its own beneficial ownership information report.

What should I do if previously reported information changes?

If there is any change to the required information about your company or its beneficial owners in a beneficial ownership information report that your company filed, your company must file an updated report no later than 30 days after the date of the change.

A reporting company is not required to file an updated report for any changes to previously reported information about a company applicant.

What should I do if I learn of an inaccuracy in a report?

If a beneficial ownership information report is inaccurate, your company must correct it no later than 30 days after the date your company became aware of the inaccuracy or had reason to know of it. This includes any inaccuracy in the required information provided about your company, its beneficial owners, or its company applicants.

Where can I find the form to report?

Access the form by going to FinCEN’s beneficial ownership information E-Filing website (https://boiefiling.fincen.gov) and select “File BOIR.”

What information will a reporting company have to report about itself?

A reporting company will have to report:

- Its legal name;

- Any trade names, “doing business as” (d/b/a), or “trading as” (t/a) names;

- The current street address of its principal place of business if that address is in the United States (for example, a U.S. reporting company’s headquarters), or, for reporting companies whose principal place of business is outside the United States, the current address from which the company conducts business in the United States (for example, a foreign reporting company’s U.S. headquarters);

- Its jurisdiction of formation or registration; and

- Its Taxpayer Identification Number (or, if a foreign reporting company has not been issued a TIN, a tax identification number issued by a foreign jurisdiction and the name of the jurisdiction).

A reporting company will also have to indicate whether it is filing an initial report, or a correction or an update of a prior report.

What information will a reporting company have to report about its beneficial owners?

For each individual who is a beneficial owner, a reporting company will have to provide:

- The individual’s name;

- Date of birth;

- Residential address; and

- An identifying number from an acceptable identification document such as a passport or U.S. driver’s license, and the name of the issuing state or jurisdiction of identification document.

The reporting company will also have to report an image of the identification document used to obtain the identifying number in item 4.

Who is a beneficial owner of a reporting company?

A beneficial owner is an individual who either directly or indirectly: (1) exercises “substantial control” over the reporting company, or (2) owns or controls at least 25% of the reporting company’s ownership interests.

What is substantial control?

An individual can exercise substantial control over a reporting company in four different ways. If the individual falls into any of the categories below, the individual is exercising substantial control:

- The individual is a senior officer (the company’s president, chief financial officer, general counsel, chief executive office, chief operating officer, or any other officer who performs a similar function).

- The individual has authority to appoint or remove certain officers or a majority of directors (or similar body) of the reporting company.

- The individual is an important decision-maker for the reporting company.

- The individual has any other form of substantial control over the reporting company as explained further in FinCEN’s Small Entity Compliance Guide.

Will a reporting company need to report any other information in addition to information about its beneficial owners?

Yes. The information that needs to be reported, however, depends on when the company was created or registered.

- If a reporting company is created or registered on or after January 1, 2024, the reporting company will need to report information about itself, its beneficial owners, and its company applicants.

- If a reporting company was created or registered before January 1, 2024, the reporting company only needs to provide information about itself and its beneficial owners. The reporting company does not need to provide information about its company applicants.

Who is a company applicant of a reporting company?

Only reporting companies created or registered on or after January 1, 2024, will need to report their company applicants.

A company that must report its company applicants will have only up to two individuals who could qualify as company applicants:

- The individual who directly files the document that creates or registers the company; and

- If more than one person is involved in the filing, the individual who is primarily responsible for directing or controlling the filing.

What information will a reporting company have to report about its company applicants?

For each individual who is a company applicant, a reporting company will have to provide:

- The individual’s name;

- Date of birth;

- Address; and

- An identifying number from an acceptable identification document such as a passport or U.S. driver’s license, and the name of the issuing state or jurisdiction of identification document.

The reporting company will also have to report an image of the identification document used to obtain the identifying number in item 4.

What is a FinCEN identifier?

A “FinCEN identifier” is a unique identifying number that FinCEN will issue to an individual or reporting company upon request after the individual or reporting company provides certain information to FinCEN. An individual or reporting company may only receive one FinCEN identifier.

How can I use a FinCEN identifier?

When a beneficial owner or company applicant has obtained a FinCEN identifier, reporting companies may report the FinCEN identifier of that individual in the place of that individual’s otherwise required personal information on a beneficial ownership information report.

What penalties do individuals face for violating beneficial ownership information reporting requirements?

As specified in the Corporate Transparency Act, a person who willfully violates the beneficial ownership information reporting requirements may be subject to civil penalties of up to $500 for each day that the violation continues. That person may also be subject to criminal penalties of up to two years imprisonment and a fine of up to $10,000. Potential violations include willfully failing to file a beneficial ownership information report, willfully filing false beneficial ownership information, or willfully failing to correct or update previously reported beneficial ownership information.

Is a reporting company responsible for ensuring the accuracy of the information that it reports to FinCEN, even if the reporting company obtains that information from another party?

Yes. It is the responsibility of the reporting company to identify its beneficial owners and company applicants, and to report those individuals to FinCEN. At the time the filing is made, each reporting company is required to certify that its report or application is true, correct, and complete. Accordingly, FinCEN expects that reporting companies will take care to verify the information they receive from their beneficial owners and company applicants before reporting it to FinCEN.

The above questions and answers consist solely of excerpts taken from the FinCEN FAQ, last updated on January 12, 2024. If you own or operate a reporting company, it is critical that you familiarize yourself with the Reporting Rule and your company’s obligations thereunder. We encourage you to read through the full FinCEN FAQ, as well as the FinCEN Small Entity Compliance Guide. Additional information, reference materials and guidance can be obtained from the FinCEN website. Please also feel free to contact Drew Kervick, Victoria Westgate or Megan Noonan with any questions about the Corporate Transparency Act or the Reporting Rule – we would be happy to help.